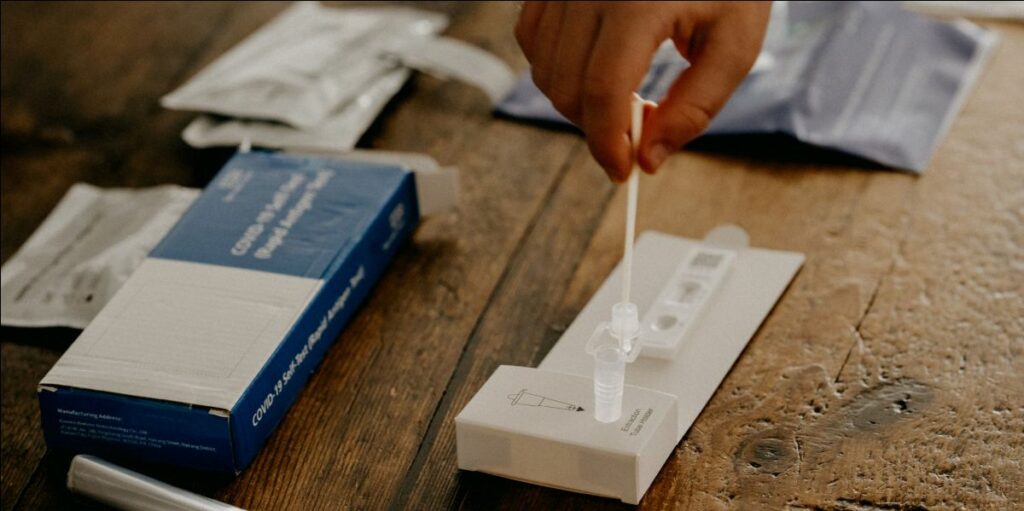

One expense many companies will be dealing with this year is the purchase of COVID-19 RAT tests.

Fortunately, COVID-19 tests purchased from 1 July 2021 for work purposes are tax-deductible.

Anytime you have provided, or reimbursed, the cost of COVID-19 tests for your employees you will able to add it as a tax deduction.

If COVID-19 tests are the only fringe benefit you provided to your employees, and you have reduced the taxable value to nil, you will not have a fringe benefits tax (FBT) liability and will not be required to lodge an FBT return.

Remember, the tests must be for a work-related purpose and can not be used if the employee uses the test for personal purposes or if they work from home.

Get in touch